|

The Financial Stability Report (FSR) is produced annually, for the previous calendar year. It summarises macroeconomic developments and local indicators of the health of the Trinidad and Tobago financial system. The FSR also provides insights into financial sector vulnerabilities and risks on the domestic, regional and international fronts. |

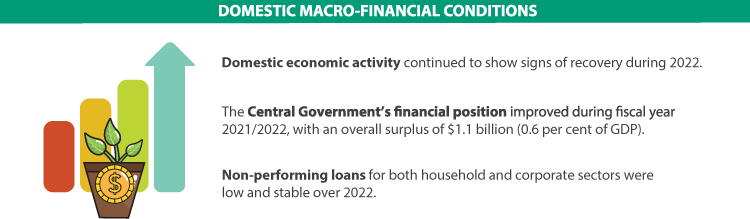

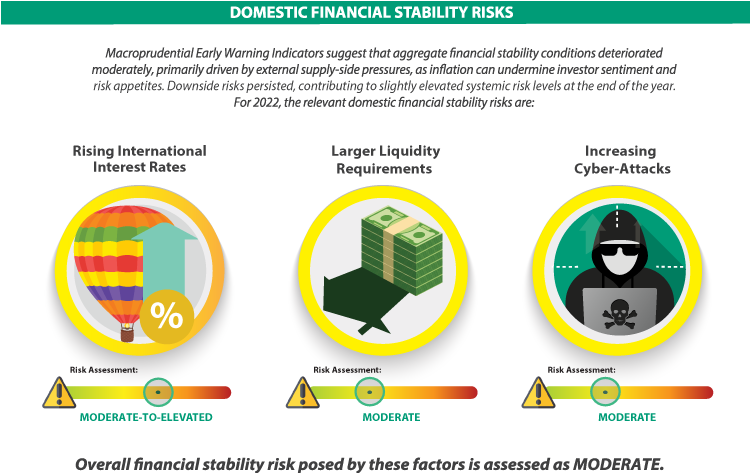

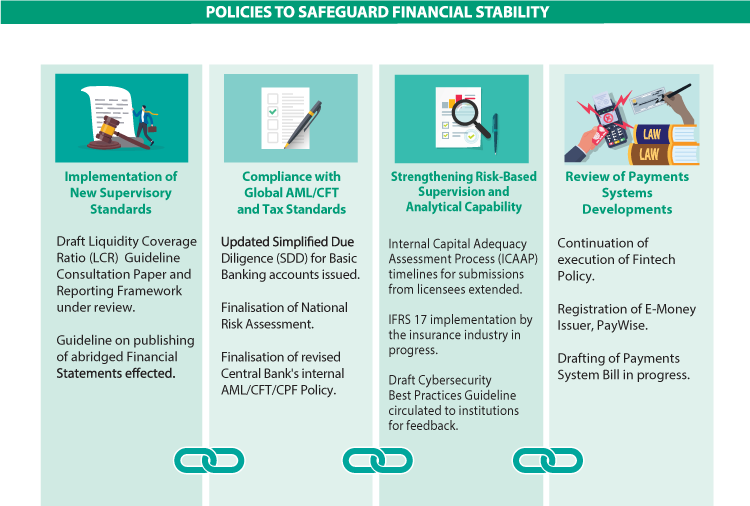

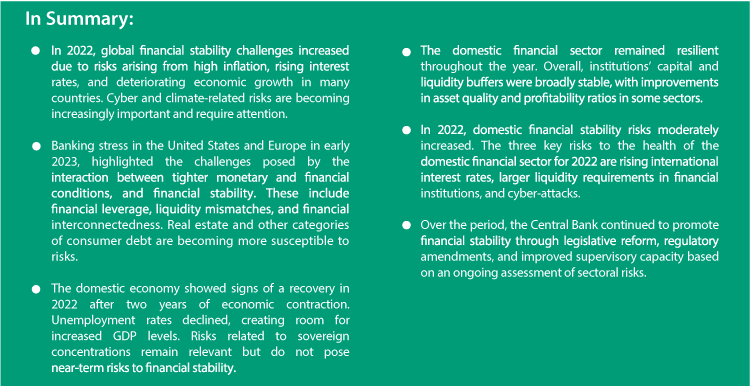

Highlights:

Visual Summary: