Explore the Central Bank of Trinidad and Tobago’s comprehensive analysis of the nation’s financial system in 2023, detailing macroeconomic developments, financial sector health indicators, and insights into vulnerabilities and risks on domestic, regional, and international fronts, providing a thorough overview of the country’s financial stability landscape.

Financial Stability Report 2024

Financial Stability Report Highlights

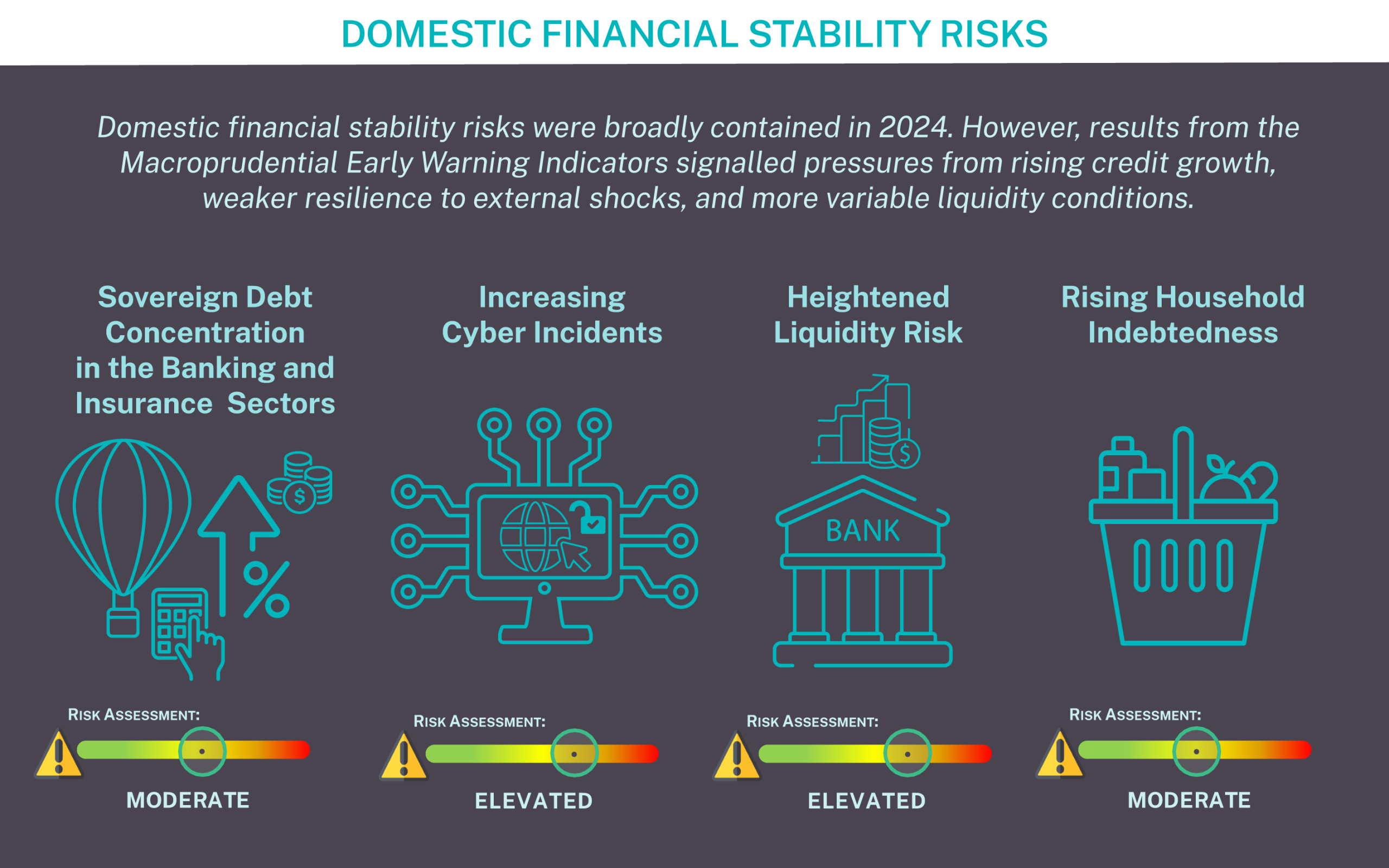

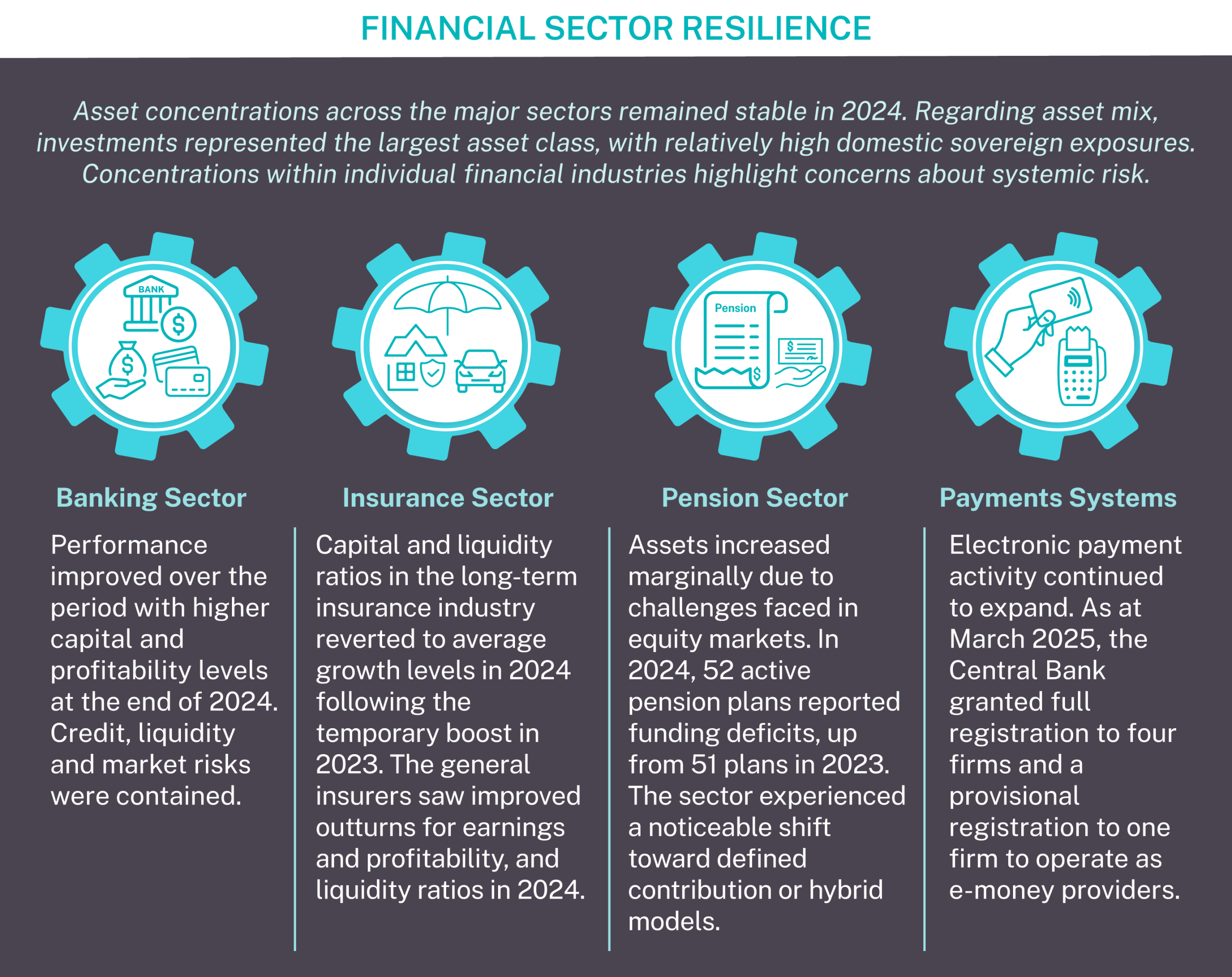

The domestic financial system remained stable in 2024, supported by strong capital buffers and profitability, low inflation and relatively improved global economic and financial conditions. Financial institutions continued to enhance their competitiveness and operational resilience through the greater integration of digital technologies. Ongoing progress in governance, risk mitigation, and policy compliance also contributed to the overall soundness of the financial system.