Delve into the Central Bank’s comprehensive analysis of Trinidad and Tobago’s economic landscape, covering global economic resilience amid geopolitical tensions, domestic GDP fluctuations, labor market trends, inflation dynamics, fiscal performance, credit growth, monetary policy decisions, and foreign reserve status as of July 2024.

Slide right to see more

Economic Bulletin Report Highlights

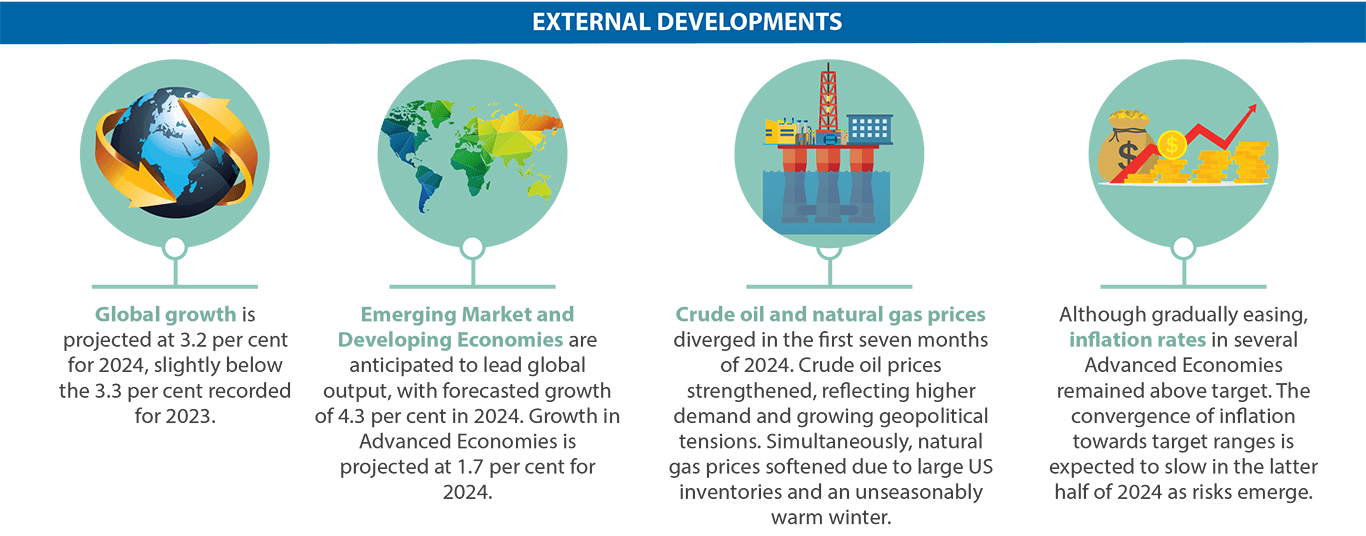

Global Growth Remains Resilient

Global growth remained steady in the first half of 2024, despite geopolitical and monetary-policy-related challenges.

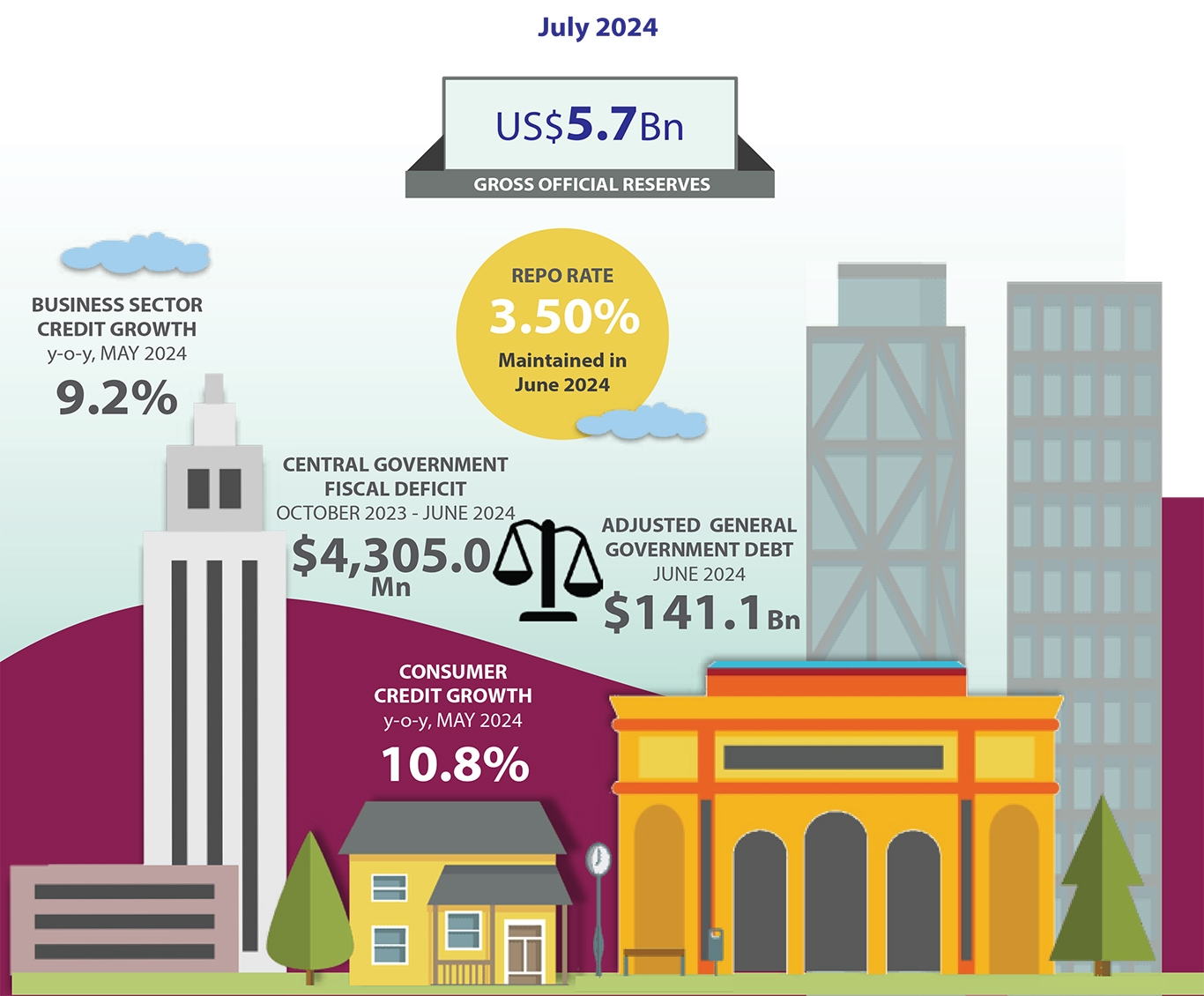

Strong Credit Growth Led by Consumer Lending

Credit remained strong, recording growth of 6.8 per cent (year-on-year) in May 2024. Credit growth was led by consumer lending.

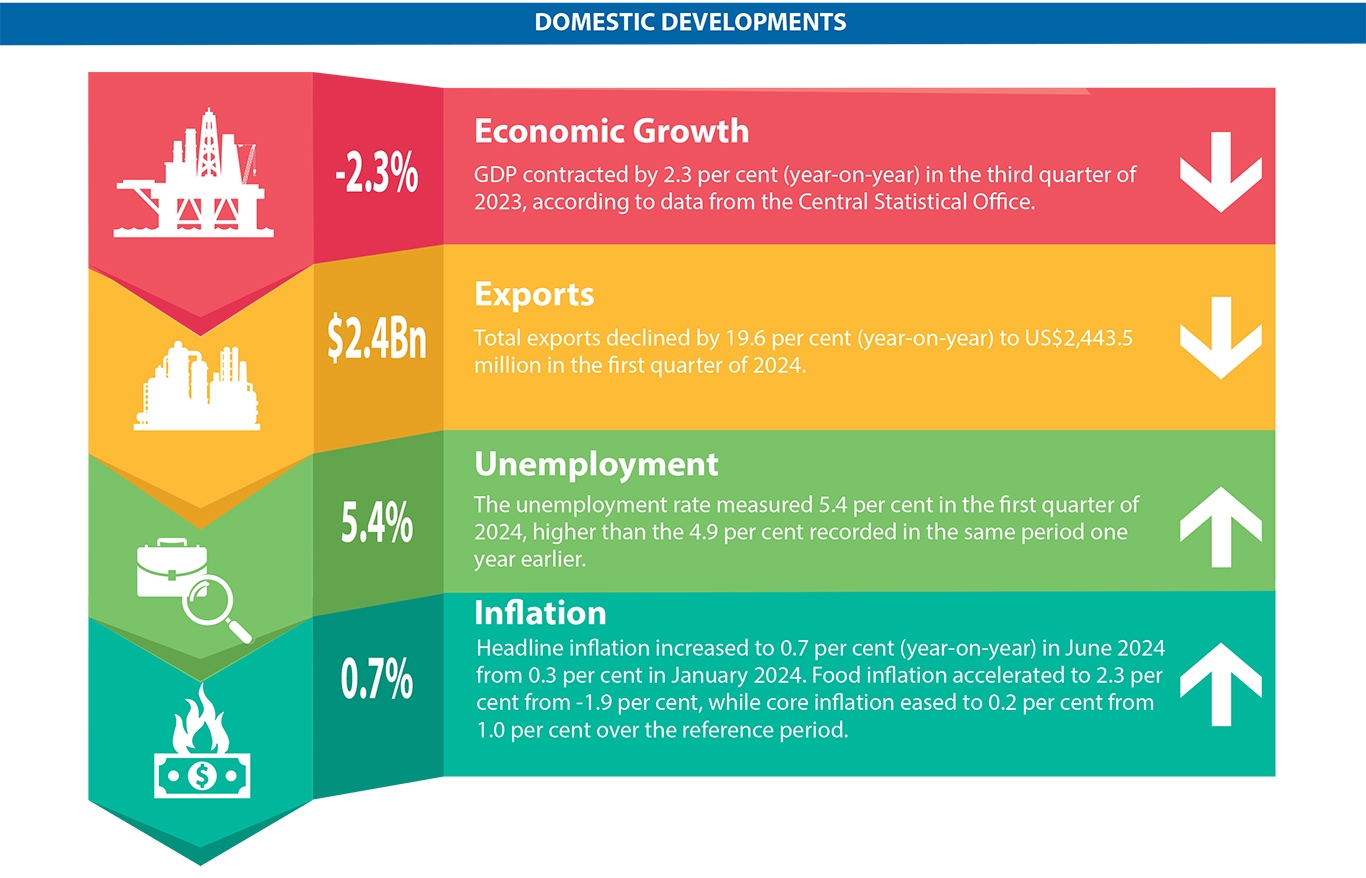

Non-Energy Sector Drives Domestic Growth

Domestically, Gross Domestic Product at constant prices (real GDP) contracted in the third quarter of 2023, as the fall in energy sector output outweighed growth in the non-energy sector. Preliminary indicators for early 2024 suggest that growth continued to be led by the non-energy sector.

Repo Rate Held Steady with Reduced Reserve Requirement

The Repo rate remained unchanged at 3.50 per cent during the first half of 2024 against a background of low inflation and favourable credit growth. Consistent with the drive towards more market-determined monetary policy instruments, on July 19, 2024, the reserve requirement was reduced to 10.0 per cent from 14.0 per cent of prescribed liabilities.

Inflation Rises Amid Softer Labour Conditions

Although still subdued, headline inflation picked up in June 2024 driven by higher food prices. Meanwhile, labour market conditions softened.

Official Reserves Provide Ample Import Cover

Gross official reserves amounted to US$5,741.6 million at the end of July 2024, equivalent to 8.1 months of import cover.

Fiscal Deficit Driven by Declining Energy Revenues

The Central Government’s fiscal accounts recorded a deficit in the first nine months of fiscal year (FY) 2023/24, as lower energy receipts outweighed the falloff in expenditure.

Non-Energy Sector Expected to Bolster Growth

Domestically, the non-energy sector is expected to be the main driver of growth. Strong business activity and a resurgence in consumer demand are anticipated to bolster non-energy spending. Conversely, in the short-run, output from the energy sector will continue to be impeded by constrained gas supplies. At the same time, a number of projects are underway to boost energy output. Headline inflation is expected to remain low in the closing months of 2024. However, while demand pressures are relatively small, adverse weather and/or changes in utility or other rates can impact certain prices.