The Central Bank Act provides for the appointment of a Board of Directors to manage the institution. Members of the Board are appointed by the President and comprise the Governor, not more than two Deputy Governors and no fewer than six other directors, two of whom may be from the Public Service. The two public service directors are to be drawn from the Ministry of Finance and from the Ministry (or appropriate Department of Government) responsible for economic planning. The other directors are selected from among persons drawn from diverse occupations and qualified by reason of their experience and capacity in matters relating to finance, economics, accountancy, industry, commerce, law and administration.

The Board has specific statutory responsibilities in accordance with certain provisions of the Central Bank Act, Chap. 79:02 and other governing legislation.

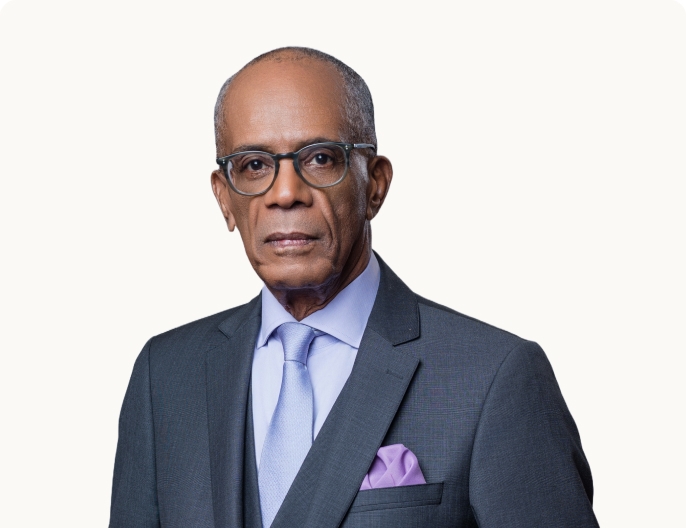

The Governor is the Chief Executive Officer and is charged with the day-to-day management, administration, direction, and control of the business of the Bank, with authority to act in all matters which are not specifically reserved for the Board.

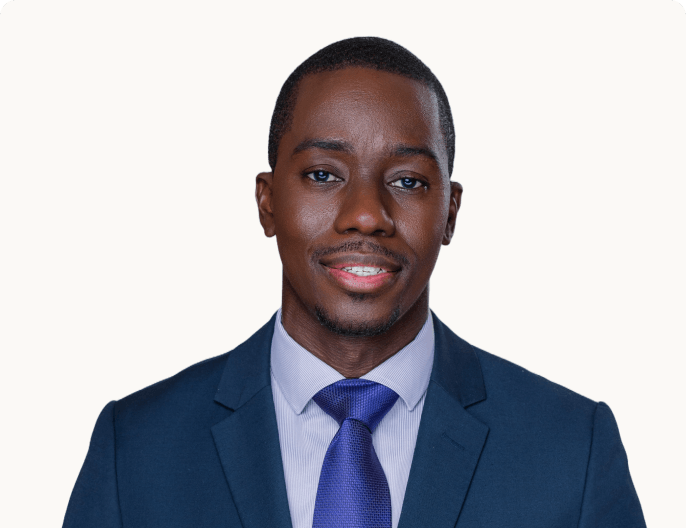

The members of the Board of Directors are shown below: