The Central Bank of Trinidad and Tobago was established by an Act of Parliament on December 12, 1964. The Bank is continuously evolving to improve its operations to meet and exceed international best practices. Today, the Bank plays a vital role in the financial sector and the country’s overall development. This timeline looks at some of the highlights from our long history.

Our History

The Central Bank of Trinidad and Tobago Turns 60

The Central Bank of Trinidad and Tobago celebrates its 60th anniversary on December 12, 2024. A 60th anniversary is a major milestone, and overall, the Central Bank of Trinidad and Tobago has been instrumental in the country’s financial sector development. The occasion of its 60th anniversary deserves to be celebrated in a memorable and meaningful way.

In commemoration, the Bank will host several events, such as exhibitions, seminars, and conferences, that highlight its achievements and contributions to the financial sector as well as the country’s development. We plan to launch a large-scale green initiative and increase our CSR outreach.

Completion of the Transition to Polymer Bank Notes

The Central Bank of Trinidad and Tobago began a phased transition to polymer banknotes in December 2019, with the introduction of the polymer $100 note and the demonetization of the paper based (cotton) $100 note as at April 1, 2020, as part of a major national security exercise. The introduction of the $5, $10 and $20 notes on November 02, 2020, marked the second phase of the transition. This continued with the introduction of the $1 and $50 polymer notes on February 15, 2021.

The final phase of the transition to polymer notes, was announced in June 2021 with the planned demonetisation of notes in the denominations $1, $5, $10, $20 and $50 bearing series dates prior to 2020, with effect from January 01, 2022. The redemption of these notes will be facilitated indefinitely at the Central Bank.

Full suite of polymer banknotes.

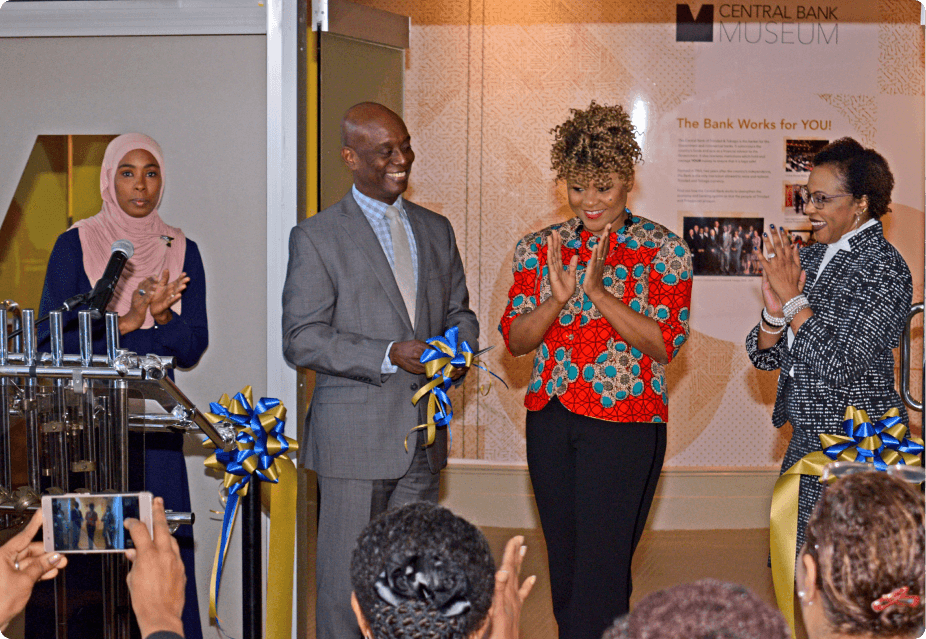

Ribbon Cutting ceremony at the Opening of the remodelled Central Bank Museum From left: Ms. Nimah Muwakil-Zakuri, Curator – Central Bank Museum; Governor Alvin Hilaire; The Honourable Dr. Nyan Gadsby-Dolly, Minister of Education, and Mrs. Nicole Crooks, Senior Manager – Human Resources, Industrial and External Relations.

Central Bank Museum Reopens with a focus on interactivity and encouraging curiosity

The Central Bank Museum underwent a much-needed redesign and rebranding to keep up with new trends in museum design, interactivity, technology, and to remain relevant. After several years of planning, the Central Bank Museum was reopened to the public on January 15, 2019. The layout, which is open and flexible, allows visitors to choose how and when they want to view and interact with the exhibits.

The Central Bank Museum has shifted its focus from a predominantly numismatic one to include the Bank’s Art Collection, which holds some of the most iconic works of art by local artists in any public or private collection in the nation. Works from the Art Collection are regularly exhibited in the Museum’s foyer. The Bank’s entire ground floor is sometimes used for year-round exhibitions.

The rebranded Central Bank Museum aims to encourage curiosity and discovery, focusing on interactivity and technology.

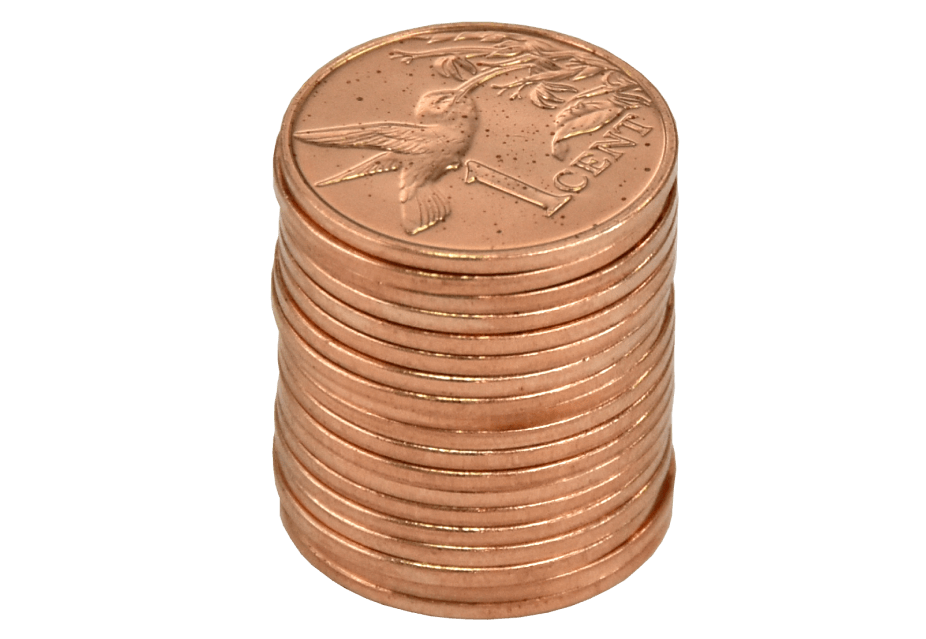

One-cent Coin taken out of Circulation

In 2018, the Central Bank of Trinidad and Tobago demonetized the one-cent coin, citing high production costs and low demand as the primary reasons for the decision. The move was met with mixed reactions from the public, with some expressing concern over the potential impact on prices, and others welcoming the simplification of transactions. The Central Bank assured the public that the demonetization would not significantly impact the economy, as the one-cent coin accounted for less than 0.1% of the total value of all coins in circulation. The move was also aligned with a global trend towards reducing the use of small-denomination coins, which are often costly to produce and handle. Demonetizing the one-cent coin is part of an ongoing effort to modernise Trinidad and Tobago’s currency and payment systems.

Central Bank Public Notice issued in 2017

Change in the composition of coins

To further enhance efficiency and reduce costs in the country’s currency management system, the composition of the 5-cent, 10-cent, and 25-cent coins was changed from copper-nickel to nickel-plated steel in 2017. This has made the coins more durable, cheaper to produce, and easier to handle. The switch to nickel-plated steel has reduced the frequency of coin replacements, saving money in the long-run. Additionally, the shift made it easier for businesses and individuals to handle and transact with coins, contributing to efficient currency handling.

The Central Bank of Trinidad and Tobago turns 50

In 2014, the Central Bank of Trinidad and Tobago proudly celebrated its 50th anniversary. The jubilant occasion was a testament to the Bank’s pivotal role in shaping the economic landscape of the twin-island nation. With a legacy grounded in integrity and innovation, the Bank’s 50 years were a journey of growth, resilience, and community impact. The festivities resonated with the spirit of progress, honouring the institution’s milestones and the people who contributed to its success. As the Central Bank embraced its golden jubilee, it celebrated the past and embarked on a future defined by continued excellence.

Front and reverse of the first polymer bank note issued by the Central Bank of Trinidad and Tobago

The First Polymer Banknote is released

Trinidad and Tobago issued its inaugural polymer $50 banknote in December 2014 to commemorate the Bank’s 50th anniversary. This modern banknote represented a departure from traditional paper currency, embracing the durability and advanced security features offered by polymer substrates. The design encapsulated the nation’s rich cultural heritage, featuring iconic landmarks, vibrant flora, and historic symbols. The transition to polymer notes aimed to enhance resilience against wear and tear, ensuring a prolonged circulation life. Using cutting-edge printing technologies, the Central Bank of Trinidad and Tobago prioritised security, incorporating intricate details and holographic elements to deter counterfeiting.

Promoting transparency and fairness through the Mortgage Market Reference Rate

The Bank introduced the Residential Real Estate Mortgage Market Guideline, which included the Mortgage Market Reference Rate (MMRR). The MMRR is a variable interest rate that serves as a benchmark for pricing mortgage loans. It is calculated as an average of the prevailing interest rates offered by commercial banks in the country. The guideline was developed to promote transparency and fairness in the mortgage market, ensuring that borrowers are not subjected to arbitrary interest rates. The MMRR is reviewed quarterly to align with prevailing market conditions, and adjustments are made as necessary to ensure that it reflects the market. The MMRR has since become an essential tool in regulating the mortgage market.

Cover of Residential Real Estate Mortgage Market Guideline

Image taken at the Launch of the National Financial Literacy Programme in 2007. From left: Nicole Crooks, Senior Manager, Human Resource and Corporate Services, Minister of Finance Conrad Enil, Governor Ewart Williams (period), Jennifer Greaves, Senior Manager, Internal Audit & Corporate Governance

National Financial Literacy Programme is launched

The National Financial Literacy Programme was intended promote financial awareness and education across Trinidad and Tobago. It was designed to equip citizens with the knowledge and skills to make informed financial decisions and improve their economic well-being. The programme targets various age groups and sectors of society, including schools, universities, workplaces, and community groups.

The National Financial Literacy Programme provides resources such as workshops, seminars, and online courses to educate individuals on budgeting, saving, investing, and debt management. The NFLP also encourages the adoption of healthy financial habits and behaviours

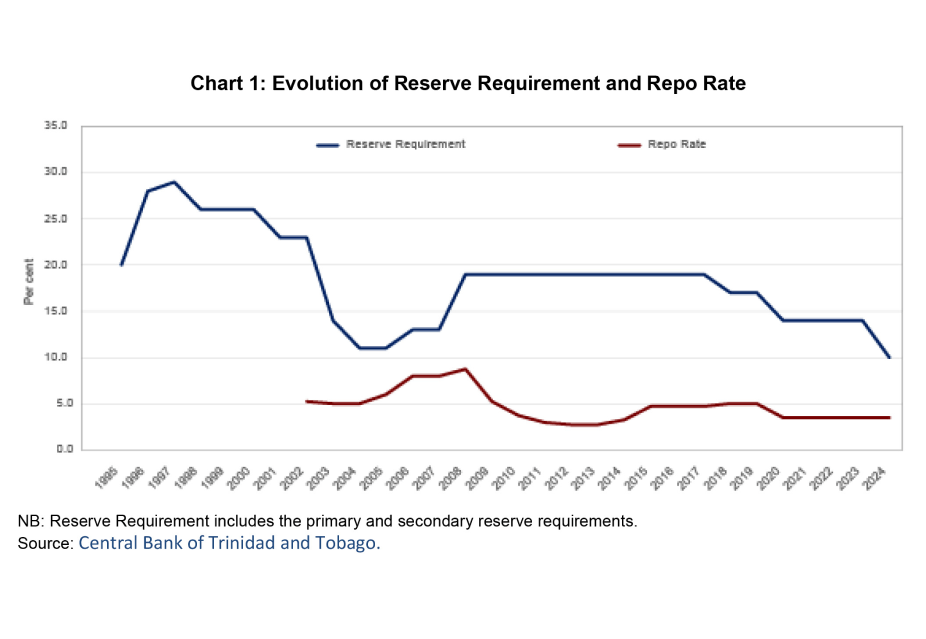

Taking Monetary Policy Forward with the Repo Rate

The Central Bank of Trinidad and Tobago launched the repo rate in 2004 as part of its modernisation efforts to improve the country’s monetary policy. The repo rate is the rate at which commercial banks can borrow funds from the Central Bank in exchange for securities. Its introduction has allowed the Central Bank to better manage liquidity in the banking system, influence short-term interest rates, and maintain price stability. The repo rate has been a vital tool for the Central Bank, enabling it to monitor and respond to changes in the economy in a timely and effective manner. Since its launch, the repo rate has become an important benchmark for financial institutions in Trinidad and Tobago.

Launch of the Office of the Financial Service Ombudsman

The Office of the Financial Services Ombudsman (OFSO) was launched in 2003 to provide a free and impartial dispute-resolution service for consumers of financial services. The OFSO aimed to address the growing need for a mechanism to resolve disputes between consumers and financial service providers without resorting to costly and time-consuming legal action.

The OFSO handles complaints related to banking, insurance, pensions, and other financial services. Since its launch, it has successfully resolved thousands of disputes. The OFSO’s role in promoting transparency and accountability in the financial sector has been widely recognised, and it continues to play a vital role in safeguarding the rights and interests of consumers.

The Birth of First Citizens Bank

In 1993, the Central Bank achieved the remarkable feat of merging three financial institutions: The National Commercial Bank (NCB), the Workers’ Bank, and the Trinidad Co-operative Bank. This led to the birth of the First Citizens Bank.

The merger was a strategic move that aimed to develop a stronger and more competitive financial institution in the country. First Citizens Bank has since become integral to the country’s economic landscape.

UTC Head Office

Liberalisation of the Financial Sector

The decade of the 1990s was a period of substantial change in Trinidad and Tobago’s financial sector, characterised by reform. The decade began with the introduction of the Financial Institutions Act, which aimed to modernise the financial sector and improve regulation. This Act led to the creation of the Central Bank of Trinidad and Tobago’s Financial System Stability Committee, which oversaw the soundness of the country’s financial institutions. As part of the structural adjustment policies adopted by the Government at this time, the Bank embarked on the liberalisation of the financial sector. This process was guided by the International Monetary Fund (IMF) and the World Bank.

The Trinidad and Tobago Stock Exchange was established in 1993, providing a platform for local companies to raise capital and investors to buy and sell securities. The decade also saw the emergence of new financial institutions, such as the Trinidad and Tobago Unit Trust Corporation. The Government’s privatisation efforts also led to the sale of State-owned banks and the entry of foreign banks into the market.

Committed to Arts and Culture

The Central Bank’s Auditorium was meticulously designed to serve as a versatile space that caters to the Bank’s internal needs, while also promoting cultural and artistic development in Trinidad and Tobago. The space is equipped with top-notch facilities and technology to provide the ideal environment for a wide range of activities such as conferences, seminars, and staff town halls. The Auditorium is one of the Bank’s contributions to the country’s cultural landscape, serving as a venue for various performances and events that showcase the arts and promote cultural exchange.

Protecting Depositors

The Deposit Insurance Corporation of Trinidad and Tobago (DIC) was established by the Central Bank and Financial Institutions (Non-Banking) (Amendment) Act, 1986 to protect depositors in the event of a banking crisis. It emerged as a proactive response to the evolving dynamics of the global financial system. The Corporation plays a vital role in maintaining stability in the financial system and preserving public confidence in the banking industry. The DIC provides insurance coverage to depositors in the event of the failure of a member financial institution, ensuring that they will receive their insured deposits in a timely manner.

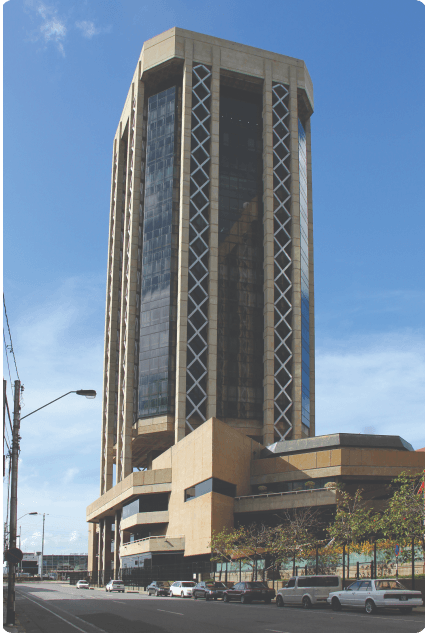

From the Treasury Building to the Twin Towers

The Central Bank moved offices to its current home at the Central Bank Tower of the Eric Williams Financial Complex, fondly referred to as the ‘Twin Towers’ by many locals.

The Home Mortgage Bank is established

The Home Mortgage Bank, one of Trinidad and Tobago’s leading financial institutions, was established to provide affordable mortgage financing options to citizens. The Bank was primarily set up to address the housing crisis and promote homeownership among citizens, especially those in the middle and lower-income brackets. Since its inception, the Home Mortgage Bank has provided access to affordable housing financing, empowering individuals and families to achieve their dreams of homeownership.

Oil Boom and Bust

In the tumultuous economic landscape of Trinidad and Tobago from 1970 to 1989, the financial sector played a pivotal role in shaping the nation’s prosperity. Fueled by the oil boom of the 1970s, there was unprecedented growth, transforming its economic dynamics. The financial sector, particularly banking and investment, burgeoned to accommodate the influx of wealth. However, this rapid expansion also exposed vulnerabilities, leading to challenges like inflation and external debt.

With falling oil prices and a fragile financial structure, the economy was faced with the prospect of near collapse. The Bank at this time played a more interventionist role within the economy by providing short-term liquidity to the commercial banks. However, this failed to prove a viable solution. The Bank was then moved to close five national financial institutions as it was given ‘emergency powers’ by way of the amendments made to the Central Bank Act and Financial Sector Acts. The Deposit Insurance Corporation and Home Mortgage Bank were established during this period. Its interventions were instrumental in mitigating the impact of external shocks on the economy.

Treasury Building circa 1967

The Central Bank of Trinidad and Tobago is established

At the end of the second World War, the financial sector was dominated and regulated by foreign institutions such as the British Currency Board (1951). It was felt that these institutions administered policies inconsistent with the requirements of the domestic economic environment.

When the Central Bank of Trinidad and Tobago was established in 1964, its primary objective was to safeguard the stability of the local currency and promote overall financial stability. Over the years, the Bank has evolved to meet the economy’s changing needs, implementing monetary policies to control inflation, foster economic growth, and ensure the soundness of the financial system.