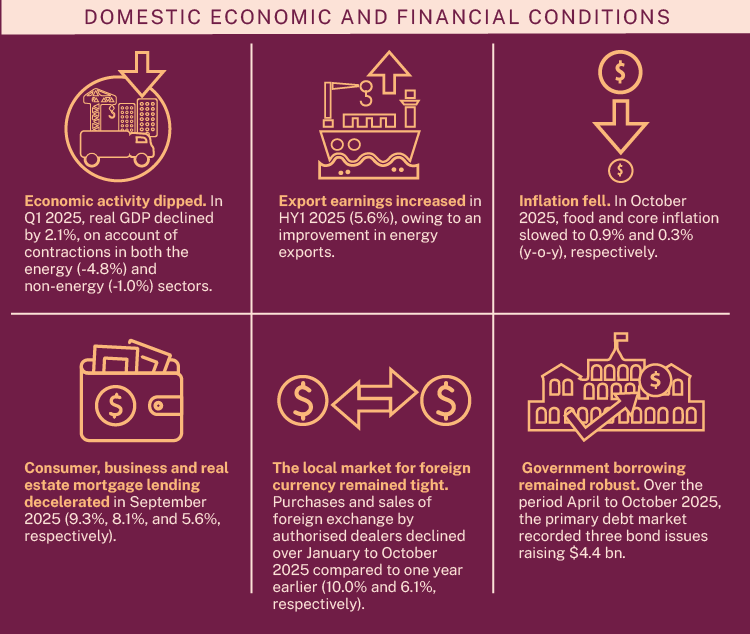

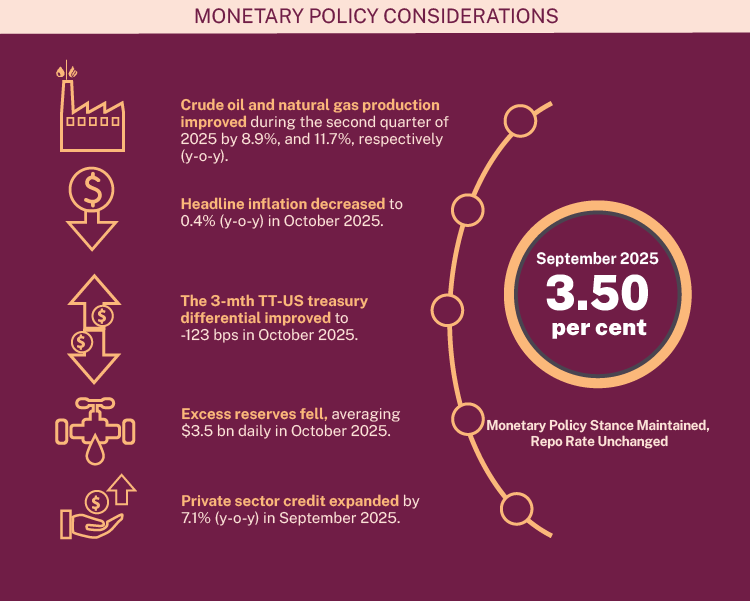

Explore the Central Bank’s latest insights on Trinidad and Tobago’s economic performance, inflation trends, and monetary policy measures. This report provides a comprehensive overview of key economic developments shaping the country’s financial landscape.

- About

- Core Functions

- Statistics

- Publications & Research

- Fintech & Payments

- Bank Notes & Coins

- News & Events

- Community Engagement

- Public Education

- Museum

- Auditorium